What would you get if you merged every independent advisory organisation into one body? A huge increase in industry systemic risk.

While I have a keen sense of humour, this is not intended as a joke.

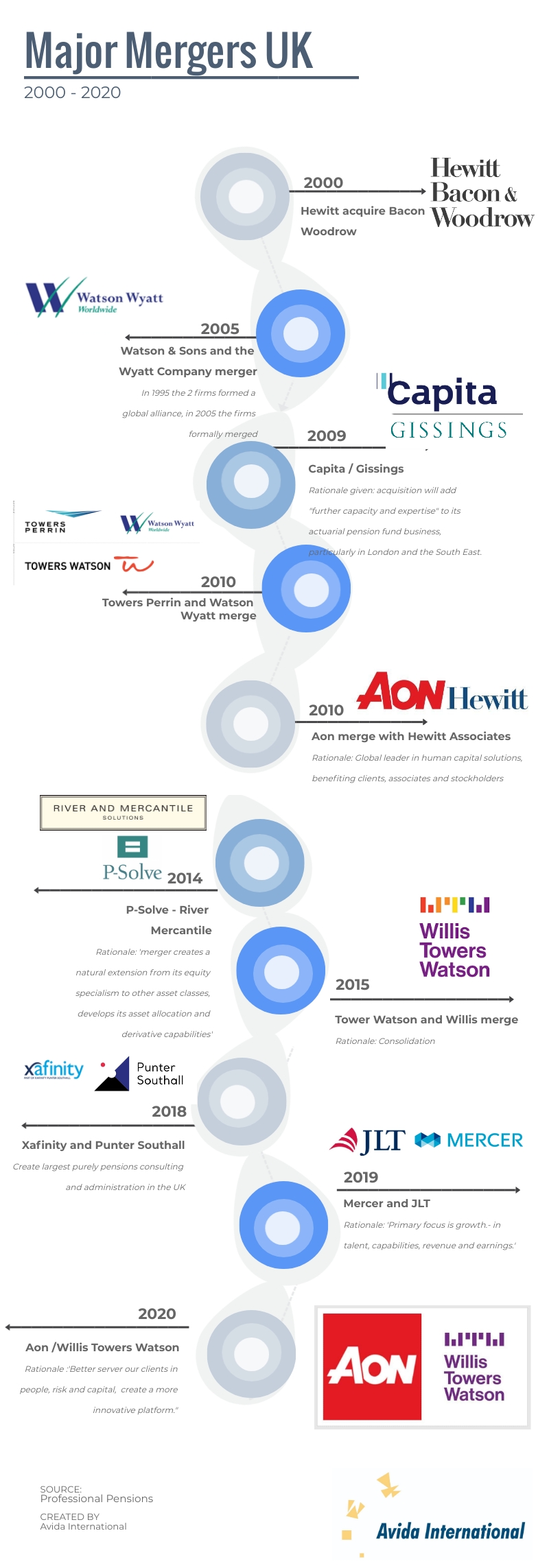

The maturing UK pension fund industry is currently being shunted in this direction with the proposed merger of industry advisory giants AON and Willis Towers Watson. Two of the biggest consultants becoming one and the consequent shrinking of advice options for funds, has consequences.

Ever since this announcement my Avida International colleagues and I have been exploring the potential implications with a number of the larger pension funds. Some of the feedback provides interesting food for thought.

feedback

Firstly there are those who are relatively relaxed about the development. Here are a few examples.

-

The bigger pension funds with in house teams already shop around and use consultants for specialist advice: they are less reliant on a single adviser

-

A number of the larger pension funds rely on their in-house investment teams for advice and the major consultants are used primarily to sense-check any recommendations so there is no critical dependency

-

Larger funds will be able to source smaller consultants to fill any gaps

concerns

However, there were some who expressed concerns regarding what advice might look like after the merger. The following quotation neatly captures that point.

“With every merger the different nuances of the previous firms are lost, and so advice gets more commoditised, generic and watered down. There is no longer the same focus on the needs of the pension scheme.”

Arguably the most interesting bit of feedback came from a very seasoned industry professional who expressed a broader concern.

“The old model (involving amongst other things ALM, fund ideas and fund manager selection, implementation, and monitoring) feels quite tired. Funds require help identifying solutions to their problems and in handling the increasing avalanche of regulations they are being faced with.”

The world of pension funds will change dramatically over the next decade. Larger funds are already very different from each other, reflecting their particular covenants and in-house skills. The decisions trustees make are harder and more final. There’s still a need for thoughtful, tailored advice. Let’s hope it will always be there.

Read more on the AON / Willis towers watson merger:

A Pinch of Salt: Thoughts on the Aon/ WTW part 1

The WTW/ Aon merger: Synergy! A 1970's disco perspective

The WTW/ Aon merger: You have more power than you think

The Aon/ WTW merger: A Keynesian perspective

The WTW/ Aon merger: To B or not to Plan B

The WTW/ Aon merger: A customer temperature update

The WTW / Aon merger: UK Pension Plans' Virgil van Dijk moment

The WTW / Aon merger: Talk About Governance

Is Big Really Beautiful? The full report on the Aon/ WTW merger