Series Title: Is your pension team fit for the DB endgame?

Part 1: They think it's all over...it is now!! Only for closed DB pension schemes it isn’t quite, which has implications for the way your scheme is now managed.

Executive Summary:

Closed DB schemes are at an inflexion point. Higher yields have brought schemes close to full funding on a buy-out basis. It follows then, that most schemes’ contributions will stop too, and soon. Cash flow will turn sharply negative.

Schemes seeking settlement will however need to pivot towards assets which can be passed to an insurer (i.e. liquid). Buy-out market capacity remains constrained implying a fifteen-to-twenty-year programme of settlement across the industry. The message is that this will take time

Larger schemes still need to pivot from growth assets to income, with tight management of liquidity.

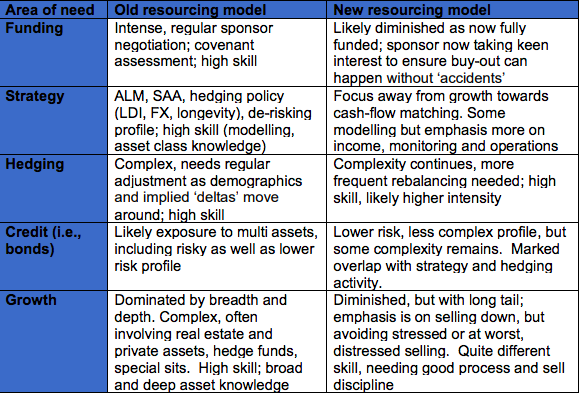

For pension teams the skills, headcount, organisational structure and cost-base now needed are very different from that supporting a balanced ‘LDI hedge and return’ portfolio.

Avida can help support schemes through this transition by advising on appropriate resourcing models, operational circuits and governance structures. Avida can also provide expert project and temporary headcount support.

The impact of higher yields and consequences for your scheme

We all know about the shocking recent rise in LDI yields, and coincident run-on collateral. However, yields were already re-setting, and have seemingly stabilised with levels unseen for twenty years. For closed DB schemes the implications are profound.

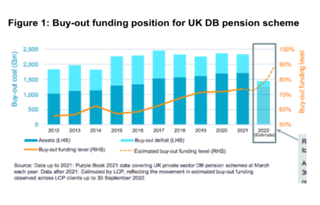

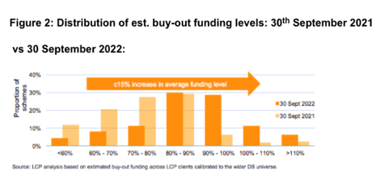

A marked improvement in funding has emerged. Even well hedged schemes have seen the actuarial balance sheet folding in on itself, with marked falls in deficit. If under-hedged, the calculus is even more favourable. A recent paper from LCP estimates an average uplift in funding level of about 15%.

Figure 1 and 2 is derived from that paper showing this effect.

Lower deficits mean existing funding plans will overshoot; sponsors will re-calibrate. Less contributions are needed, for most schemes buy-out is in sight. For large schemes, some sort of self-managed buy-in must surely be close. Barnet Waddingham’s DB End Gauge index (average time to reaching buy-out funding) now sits at about 6 years.

However, there’s a catch. Insurers like polished admin data, ‘clean’ assets, and are constrained by capital, risk appetites, and resourcing. We hear the latter is a particular pinch point right now, unlikely to be resolved any time soon. Appetite for illiquid and complex assets is very low, if at all.

Most estimates we’ve seen put insurance capacity at about £50bn pa. This against total demand of about £1trn. An average time to buy out may be ten years, even if fully funded soon.

We suggest having a clear plan, guided by the following:

- Converging to buy-out funding (or so called ‘low dependency’, for large schemes). Okay everyone knows this; it's mentioned for completeness...

- Re-orienting assets towards insurance friendly appetites (if buying out), or a low dependency portfolio (large schemes)

- Maintaining high(-ish) hedge ratios, whilst preserving resilience/dynamic response to rates shocks

- Marked transition to cash flow negative investment profile (as corporate contributions are turned off)

- Delivering cash flow as per liability outflows - a sort of ‘creeping barrage’ of asset cash flows choreographed to match liability outgo

What might this mean for your pension team?

Figure 3 gives a high-level summary of what you might have and what you might need, and the changes required in pension executive resourcing:

Source: Avida International

To sum up, we think closed DB schemes are at an inflexion point. Schemes need to evolve to a more operationally focussed resourcing model with an objective of converging, through time, to buy-out (small/medium), or ‘low dependency’ (large)’. Buy-out capacity is constrained, and portfolios need to be simplified, ready to transact. This will likely take time, as selling down will need delicate handling.

For your own scheme the above hopefully gives a framework to think about needs.

Avida can help support schemes through this transition by advising on appropriate resourcing models, operational circuits and governance structures. If necessary, Avida can also provide expert project and temporary headcount support.