Why delegation still matters: The governance shift pension funds can’t ignore

Introduction

When in the complex world of pension fund management, market circumstances force quick decision making, effective governance isn’t just a regulatory obligation—it’s a strategic necessity, the value of which is especially evident in volatile markets. This is why one of the most powerful tools available to Trustee Boards is the thoughtful delegation of operational investment decision-making. Whether authority is delegated to a dedicated project team or to a scheme CEO or CIO, the benefits are substantial: faster decisions, deeper expertise, and a governance structure capable of keeping pace with a rapidly evolving investment landscape. However, this assertion is based on 2 key assumptions; that the entity receiving the delegated authority is properly resourced and that there is effective and transparent reporting on those delegations back to the Trustee Boards.

The Increasing Complexity of Pension Fund Investments

Pension funds operate in a complex environment shaped by volatile markets, heightened regulatory expectations, and a proliferation of new asset classes. Private markets, in particular, have become a core component of many schemes’ portfolios but they can bring with them long lockups, complex structures, and limited liquidity. Trustee Boards – typically composed of individuals with diverse professional backgrounds and limited time – are often not best-placed to make time-sensitive investment decisions across all of their portfolio directly. They need help to do so.

Appropriate delegation provides this support but is not a dilution of trustee responsibility; rather it is a recognition that modern pension schemes require specialist knowledge, operational agility, and clear communication.

Why Trustee Boards Should Delegate (Within Constraints)

1. Access to Deep, Embedded Expertise

Delegating decision making to a CEO/CIO ensures that investment decisions are informed by a leader who already understands the scheme’s history, risk appetite, funding journey, and operational nuances. This continuity is invaluable. The CEO/CIO is immersed in markets daily, supported by internal teams and, often, external advisers, and so is able to evaluate opportunities with a level of sophistication and nimbleness that cannot otherwise be replicated.

2. Improved Speed & Responsiveness

Financial markets can sometimes move quickly. Think of the rapid push to re-balance in response to the 2022 gilt crisis, buying a distressed asset or – very topical in these days of de-risking - selling a private equity or infrastructure fund interest on the secondary market. Successful management in such circumstances requires rapid engagement with custodians, brokers or platforms, negotiation of pricing, and assessment of discounts. A Trustee Board that meets quarterly simply cannot respond with the necessary speed. Delegation empowers the CEO/CIO or a project team to act within agreed parameters, helping a scheme to best achieve its investment objectives.

3. Stronger Governance & Risk Management

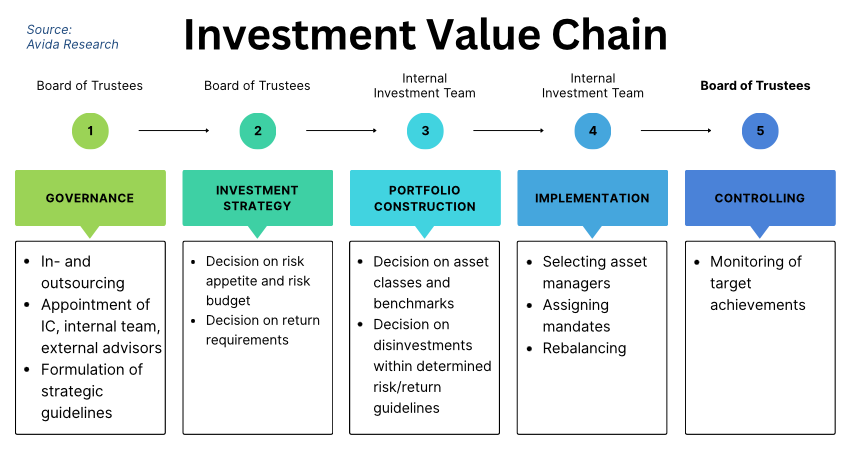

Delegation allows Trustee Boards to focus on what they do best: set strategy, define risk appetite, and oversee outcomes. By separating strategic oversight from non-strategic decision-making, pension funds create a governance model that is clearer, more accountable, and more resilient. The following investment value chain may serve as an illustration:

The Critical Role of Managing Expectations

Effective delegation is not only about who makes decisions and how they are made; it’s also about how expectations are managed. Selling (or buying) an illiquid private markets investment on the secondary market provides a perfect example. In such an instance discounts may be larger than trustees or sponsors expect, timelines may be uncertain, and negotiations can be opaque. The CEO/CIO or project team adds value by ensuring that stakeholders have a realistic understanding of:

Likely pricing outcomes

Market appetite and liquidity conditions

Execution timelines

Risks of delaying or accelerating the sale

Managing expectations builds trust, aligns stakeholders, and reduces the risk of misinterpretation or disappointment. Likewise, the Trustee should clearly communicate appropriate constraints to the CEO/CIO or project team driven by strategic considerations, for example, the maximum acceptable discount.

Delegation to a Project Team

Project teams are particularly valuable during complex transactions such as secondary market sales. They bring together internal staff, external advisers, the scheme’s OCIO / Fiduciary Manager if they have one and subject-matter experts to deliver a defined outcome efficiently. Clear expectation setting ensures that trustees and sponsors understand the project’s scope, milestones, and potential risks.

Delegation to the CEO/CIO

Where the scheme has a CEO/CIO embedded within the organisation, delegation can be even more effective. The CEO/CIO brings continuity, institutional memory, and a deep understanding of the scheme’s long-term objectives. They are also well‑placed to manage expectations – translating complex market dynamics into clear, actionable insights for trustees and sponsors, and ensuring that decisions remain aligned with the scheme’s strategic goals.

Conclusion

Delegation is not merely an operational choice; it is a governance imperative. By empowering project teams or an existing CEO/CIO—and ensuring they actively manage expectations—Trustee Boards position their pension funds for success. In a world where complexity is on the increase and the stakes are high, smart delegation supported by transparent communication is one of the most responsible decisions trustees can make.

How Avida can help

Create effective governance structures and authorities

Design of oversight

Share knowledge on innovative external solutions