Unlocking Opportunities in Asia Pacific Real Estate:

The role of specialist advisors in optimising investment in the region’s markets

Written by Dorothee Franzen & Bas van den IJssel

Background

Demand for Asia-Pacific commercial real estate investment has surged considerably in 2025, reaching record levels in Q3, up nearly 60% year over year (1). A significant spike in activity accompanied increased foreign capital targeting the region. Institutions are drawn to many benefits outlined in our earlier article about investing in the Asia Pacific (APAC) region. However, investors looking for suitable opportunities in the area need experience to optimise returns and effectively manage risks in APAC real estate.

Introduction

Investment volumes in Q3 are expected to increase conservatively by 10% from 2024 levels for the whole year (2). Institutional investors are clearly beginning to recognise the benefits of real estate investment in the region. Investors like the APAC region for its balanced risk-return profile, including its real estate and resilient, growth-oriented markets.

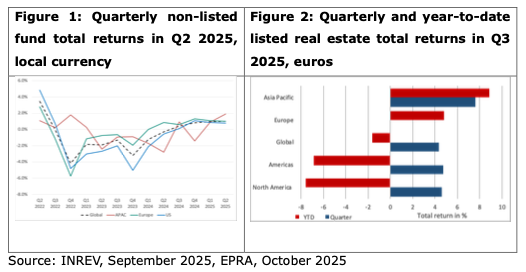

Encouragingly, for these investors, the region's unlisted markets have started to perform positively. Asia Pacific non-listed funds were the strongest performers in Q2 2025. Likewise, the region's listed property companies and REITs have outperformed their US and European counterparts in both the third quarter and since the start of 2025. The equity real estate markets are usually a reliable indicator of future private market performance, which should prove positive for Asia Pacific non-listed real estate markets (See Figures 1 and 2 below).

The challenge of investing in the region: Choosing fund managers and investment vehicles

The region's real estate markets are proving increasingly attractive. Like real estate in other regions, they benefit from low volatility, access to growth economies, growing property sectors, and low correlations with other regions.

Strategy and manager selection

Regional asset management ability varies in terms of AUM, with managers with more than €10bn invested across the region commonplace. An essential consideration is the company's personnel strategy for managing its capital, how GPs guarantee continuity of management throughout the investment's life, and how they address "key person" risk.

Most major global managers operate in the APAC region and typically provide multi-sector regional core and value-added funds. Additionally, there are more specialised managers, particularly in Australia, where a broad range of large, well-established local firms offer funds spanning from core to value-added strategies. If investors seek a position on the Investment Committee, Limited Partners (LPs) can gain access at investment levels of around $50 million or more, similar to other regions.

Investment strategy

The investment and portfolio strategy should align with the client's investment goals. The main reason for investing in the APAC region is to achieve attractive risk-adjusted returns while taking advantage of the diversification opportunities offered by its real estate market to international investors.

APAC fund structures include open-ended, closed-ended, and co-mingled structures, with co-investment options varying widely. Pan APAC funds are mainly domiciled in Luxembourg, and cater to different risk levels, including core, core-plus and value-add. Country focussed funds are mainly structured in the country, sometimes also via Luxembourg or provide a Luxembourg feeder fund. The key sectors targeted are Office, Industrial, Living (e.g. traditional multi-family and student housing), Retail, and niche areas such as health care with a growing focus on living and industrial spaces. Affordable housing is gaining importance. Country strategies mainly focus on Australia and Japan, with New Zealand, Singapore, and South Korea also involved. While some funds specify minimum or maximum exposures around 40%, most lack explicit targets. Investment sizes usually start from $10 million. Redemption queues in APAC tend to fluctuate with market cycles, but during this cycle, most pan-APAC funds did not experience large redemptions, and most managers paid out redemptions efficiently. Under the SFDR directive, designations vary, with Article 8 funds being the most common, though many APAC funds have none.

Returns and fees

Today, typical net fund returns are around 7 to 9% for core, 9 to 11% for core-plus investments, and 12% for value-add strategies, which are likely to reach the higher end of these ranges in the current cycle. Investors can expect income returns above 4%, although these will vary across sectors and countries, as in other regions. Management and performance fee structures vary greatly, as do the overall Total Expense Ratios (TERs). APAC managers differ in their approach to charging performance fees; when they do, hurdle rates usually are 7% or 8%. Investors should evaluate how performance fees affect their investments, especially considering catch-up fees and high-water mark charges. Pan APAC funds are denominated in USD and currency effects, such as the devaluation of the dollar, can affect performance and therefore the performance fee, making clauses like a high-water marks extra important.

Debt and equity management

Recent years have been challenging for managers raising capital in APAC, which has the advantage that investment queues tend to be short. Moreover, several managers are offering fee discounts. Furthermore, advisors can group their investors to achieve a more attractive fee structure. Despite discounts, secondary-market trading is currently limited.

Debt strategies vary across the region. Leverage rates vary according to approach, from around 30-40% for core to 60/65% for opportunistic. In Japan, Loan-to-Value (LTV) levels are currently higher, given the generally lower interest rates. But some managers are aware of European preferences for lower LTV levels and cap them at 50%. Nonetheless, due to Japan's low interest rates, interest coverage ratios remain reasonable even at LTVs of 50%.

Governance

Funds in the APAC region generally have robust governance structures, partly because many are managed globally and follow governance practices similar to those of US funds. Additionally, the corporate governance guidelines of ANREV and its members are widely adopted and conveniently align with those of INREV. Investor voting processes are similar to those in the European fund market, and investor advisory committees operate comparably to their European counterparts.

Reporting across APAC has become increasingly standardised and generally aligns with the level seen in Europe and North America. In our experience, it has been straightforward to incorporate additional requirements, such as INREV SDDS, through a side-letter request.

Sustainability

Larger funds typically emphasise sustainability and participate in GRESB. In general, the APAC investment market, especially outside Australia, places a lower priority on sustainability. However, many funds do aim to embed it into their operations. For instance, in Japan—where sustainability has been adopted more slowly in investment management—modern logistics firms are now actively assessing and creating policies to manage sustainability risks where some could be considered global leaders.

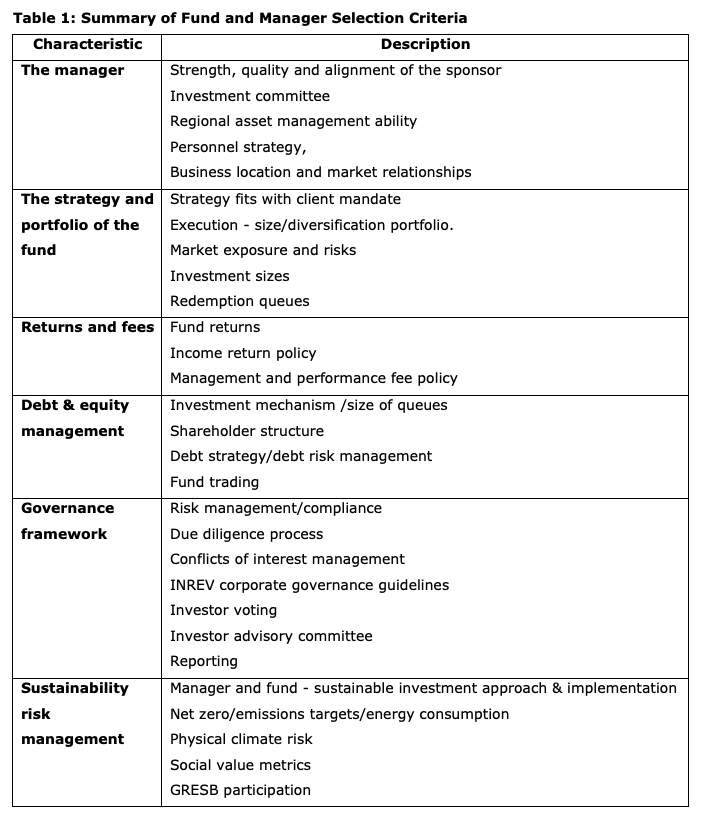

In table 1 we provide a checklist for investors who prefer to venture out by themselves without support by consultants. In our experience, investors should also look out closely to be in the boat with like-minded investors. Otherwise, if times get tough, it could become difficult agreeing on a successful exit strategy.

Conclusion

Many European investors are now seeking opportunities in the Asia Pacific's real estate markets. The pull of the APAC region is clear, offering stable economic policy, favourable demographics, growth opportunities, diversification and increasingly professional and transparent property markets. Despite these favourable qualities, it is unrealistic to expect investors unfamiliar with the region's real estate markets to begin making major long-term capital allocation decisions without in-house or external advisors, providing specialist real estate expertise. Investors must evaluate numerous complex factors when deciding how to allocate their capital. This challenge is especially pronounced in markets with variable market liquidity and data that is harder to access.

How Almazara can help

To maximise opportunities in the APAC region, institutional investors should work with experienced advisors who understand market complexities and the fund manager landscape. Almazara can handle client and portfolio risk, assess funds, select managers, negotiate fees, manage investments and redemptions, and maintain market relationships. We’d be happy to support European investors to capitalise on the growing variety of funds emerging in the region's markets over the coming years.

1 Source: Knight Frank’s Q3 2025 Capital Markets Insights.

2 Source: Knight Frank, 2025