Opportunities in Asia Pacific Real Estate Markets

Written by Dr. Dorothee Franzen and Bas van den IJssel

Why APAC Real Estate Now?

The market uncertainty generated by rapidly changing US macroeconomic and geopolitical policies poses significant dilemmas for real estate investors. While the US remains the largest, most diverse, and liquid real estate investment market, investors are considering all their options for their allocations, including opportunities in other regions.

The key issue for the real estate sector is finding attractive, risk-adjusted return alternatives, alongside liquidity, sector alternatives, and transparency, which North American and particularly US markets have offered. Is the Asia Pacific (APAC) region a realistic alternative to the US for European institutional investors?

Contrary to intuition, investing in APAC real estate differs from emerging market investing. Japan, Australia, and New Zealand constitute 60% of the market, while Singapore and South Korea together account for an additional 32% of market volume. Investing in APAC real estate mainly involves developed OECD countries. Therefore, the Asia Pacific region offers a diverse array of large, liquid, highly urbanised, and sophisticated markets across various sectors. Investors seek it for its potential to deliver attractive risk-adjusted returns, diversification, and access to sufficiently liquid and transparent markets. This article explores the opportunities that Asia provides as an alternative to North America and as a complement to Europe.

Changes in US policy could indicate either short-term policy fluctuations or long-term structural shifts, potentially affecting future risks and returns. The primary concern is uncertainty. Although the US real estate market remains fundamentally unchanged, we expect uncertainty to persist until at least the summer. We anticipate investors will stick to their existing allocation strategies but explore contingency plans in other markets, such as the APAC region, especially among real estate investors.

The APAC Real Estate Market Has Inherent Institutional Investor Appeal

The APAC market is a dynamic, multifaceted arena that offers both growth and stability. For institutional investors, such as pension funds and German investment managers, seeking diversification away from traditional European and US assets, APAC real estate offers an effective hedge against volatility, an avenue to capture regional economic and sectoral momentum, and the counter-cyclical balance that today’s markets demand.

Pension funds and institutional investors gain from predictable income streams, long-term capital preservation, and attractive yield spreads in core assets.

Over the past decade, the region has demonstrated balanced risk-return attributes. For instance, diversified core assets in Japan and Australia have generated annual total returns generally in the 5–9% range while maintaining lower volatility compared to volatile emerging markets.

Attractive Returns, Risk and Diversification

Investors are constantly seeking undervalued assets. As Asia becomes more professional and transparent, it will offer greater opportunities for international capital. European investors can access markets undergoing structural reforms. For instance, as APAC markets continue to recalibrate after the COVID pandemic and adapt to ongoing US policy-driven market turbulence, European capital can seize value during these cycles.

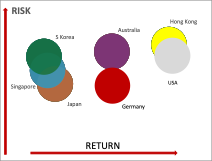

While US markets have historically offered high returns, albeit with added volatility, APAC markets have combined returns that are more attractive than those of European markets, while also offering noticeably lower levels of risk than the US. Moreover, within the region, historical data at the asset level confirm the attractive risk-return on offer to real estate investors. The returns on offer in the major developed markets of APAC are consistently more substantial than those in markets like Germany, while risk remains relatively constrained.

Figure: 1 Core funds risk returns since Q4 2010 to Q4 2024

Source: INREV, June 2025. The USA is the ODCE index.

Figure 2: Direct market country risk returns since 2010

Figure 3: Direct market sector risk returns since 2010

Source: JPM, Savills IM, various

Source: JPM, Savills IM, various

In addition to favourable risk-return characteristics, Asia offers a strong diversification component for global investors, particularly those based in Europe and Germany. The APAC region’s enhanced diversification is demonstrated by its low correlation with European and US markets, which means adding assets from these markets can reduce overall portfolio risk and balance cyclicality. Investing in a portfolio that spans the APAC region can help reduce market volatility, diversify investments, enable investors to adjust income streams over time, and contribute to more stable long-term returns.

Source: FTSE EPRA Nareit, June 2025, weekly returns correlated since 2016. JPM, Savills IM, and M&G. Europe = continental Europe

The Market Opportunity: Economics and Demographics

The developed APAC economies offer robust growth trajectories with high-quality human capital. The broader Asia–Pacific region is set to remain the world’s fastest-growing region, driven in large part by resilient domestic demand in advanced economies like Japan and Australia, as well as a gradual rebound in exports from export-oriented hubs such as South Korea.

Decades of trade liberalisation have transformed developed APAC open markets with strong governance into attractive destinations for steady foreign direct investment, particularly in advanced manufacturing, high-tech, and services. Despite the current turbulence in trade policy, they are well-positioned for robust growth.

Japan, South Korea and Australia rank among the world’s top economies by GDP per capita. These markets, especially the major cities, benefit from stable policy frameworks, sophisticated infrastructure and affluent consumer bases that underpin business growth and investment. The region scores highly on international comparisons in terms of human capital, with recognised excellence in educational attainment, while health outcomes are amongst the leading in OECD league tables.

It’s a region with its demographic challenges. Still, while fertility rates have dropped and dependency ratios have increased, there’s a growing recognition of the economic benefits to be gained from an ever-increasing “Silver” economy. It’s also important to recognise that demographics are regional, and not national. Japan, for example, is experiencing a population decline, while Tokyo and Osaka are two city regions experiencing significant population growth, particularly amongst younger population groups. In addition, Australia’s population is growing faster than that of Germany, Europe, the US, and Canada. Governments’ policies aimed at attracting skilled migrants and investing heavily in robotics and automation have wider economic benefits for the region’s economies. The region is experiencing growing internet penetration, which will benefit businesses and consumption, with positive impacts across the real estate sectors.

The Market Opportunity: The investability of APAC Real Estate Markets

The APAC region accounts for approximately 25% of the global investable universe. Mature markets such as Singapore and Japan offer transparency and institutional-grade governance, which aligns with the risk-averse nature of German regulatory frameworks.

But that share is growing. The markets of Australia, Japan, Singapore, Hong Kong, and South Korea account for more than four-fifths of the investible market, with Japan accounting for around a third and Australia a fifth of the region’s investible market (Source: JPM, ANREV 2025).

The investible real estate market is currently dominated by the office sector, with the industrial sector becoming a growing presence in investors’ allocations across the region. Similarly, the living sector is gaining prominence, with the non-listed sector being particularly well-represented in this market segment.

Source: ANREV Open-end Diversified Core fund June 2025, JPM, ANREV, INREV

Public Real Estate Markets Are Sending a Signal to Look Eastwards

The publicly traded listed real estate markets have responded to the uncertainty generated by changing US policy. It’s notable that while the US market sold off sharply after the trade tariff announcements in April, markets in Asia, particularly those in Japan, held up relatively well. Although REITs recovered in the US from late April onwards, they are still lagging other regions considerably, with Japan being one of the standout performers.

Figure 8: Listed real estate returns in 2025, by region and country, euros

Source: FTSE Epra Nareit, 31 May 2025

The rapid pace of policy changes, which have profoundly troubled capital markets, including REITs, makes it challenging for investors to develop a coherent global and regional allocation strategy. While market volatility has declined measurably, the US government remains engaged in complex bilateral tariff negotiations and is renegotiating various foreign policy and defence agreements. It is about to implement fiscal changes with profound implications for international investors. Investors will need time to evaluate whether the current changes in US trade policy, in particular, are structural and necessitate a fundamental review of the risks associated with investing in US real estate markets.

Consequently, we expect some will review the Asia Pacific (APAC) region as an alternative destination for their capital, if they are unconvinced by the implications for their portfolios of developments in North America. The APAC region stands apart as a mature, resilient, and growth-driven market. Stable economies, strategic growth sectors, and a low correlation with European and North American real estate characterise it. APAC markets have shown balanced risk-return attributes over the past decade. Structural transformations and gradual market repricing have created attractive entry points, allowing pension funds to secure assets at favourable yields, often ahead of broader market movements. The developed Asia markets are increasingly professional, providing transparency and institutional-grade governance, which appeals to the risk-averse nature of German regulatory frameworks.

Taken together, these factors—persistent GDP growth, open trade regimes, advanced infrastructure, top-tier human capital, and adaptive demographic policies—make the developed APAC region among the most attractive globally for both investors and high-value industries. The APAC region could offer investors a timely strategic alternative to the US, providing both capital appreciation and risk mitigation.