Everyone talks about the power of Big Data. We are told these huge volumes of continuously generated data, if appropriately analysed, have the potential to help address business problems that it was not possible to tackle previously. Unsurprisingly such a possibility is exciting a lot of business executives.

So, what about the, let’s call it “Small Data”, that already exists both in raw state and in information form? Can we say, hand on heart, that we are making full use of that to drive our organisations forward?

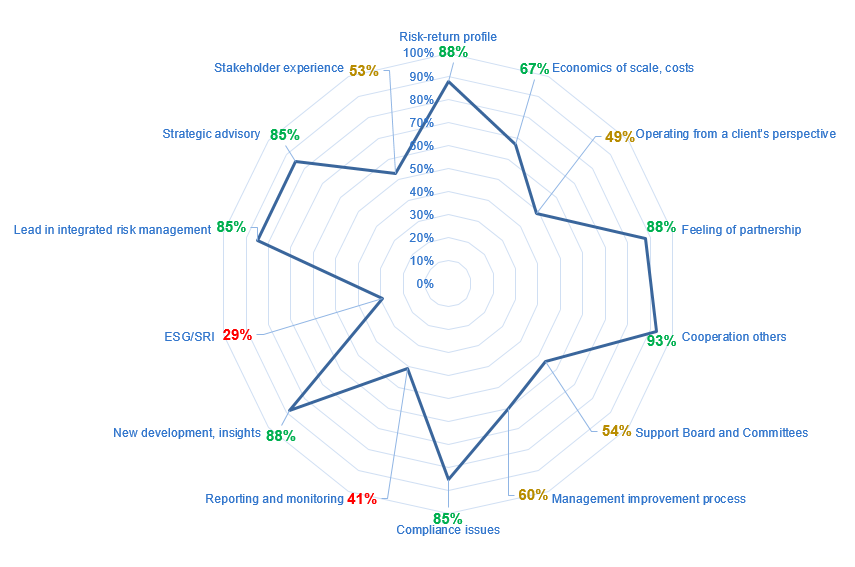

use of data by asset owners

In the case of investors and asset owners, the answer to this question is certainly yes. For many years macroeconomic data allied to the numbers and information on the companies that make up our investment universe have been the staple diet on which they have fed. As economies and markets have increased in complexity, so we have witnessed huge growth in a myriad of suppliers to these investors and asset owners focused on ensuring this data gets to the end-user whilst providing the added value of analysis and insight.

More recently, and especially in the aftermath of the global financial crisis, mathematicians and physicists have taken centre stage. These risk management experts, or “brains-on-sticks” as I once heard them uncharitably described, have made an enormous contribution to the way we think about how asset owners and their suppliers make decisions that impact on the well-being of millions of savers and pension fund members.

client satisfaction data for asset managers

Which begs the question why our industry seems to apply so little of this scientific rigour to thinking about how its customers are feeling? Thankfully we have moved on from the attitude that says, “I know my customers so well that I’m totally in touch with how satisfied they feel”. Yet our industry seems strangely reluctant to invest time and effort in the compilation of meaningful customer satisfaction data. For if it is possible to generate data that would help ascertain how our clients feel about us, why would we not do that? Furthermore, if it is also possible for us to evaluate how that satisfaction level compares to the general market trend, surely that would be a potential source of invaluable competitive advantage that any organisation would want to obtain?

"Our industry seems strangely reluctant to invest time and effort in the compilation of meaningful customer satisfaction data."

customer loyalty

But equally, it is clear that such data and the information that flows from it, cannot of itself be depended upon to deliver success. Rather the critical element to consider is what should be done with it? To maximise its benefit, the truly successful organisations will want to gather all possible insights concerning how customers feel about them, even when this may involve having to face some uncomfortable home truths. The really switched on organisations will be those turning “Small Data” into the biggest of all competitive advantages – strong customer loyalty resulting from the implementation of successful retention strategies.